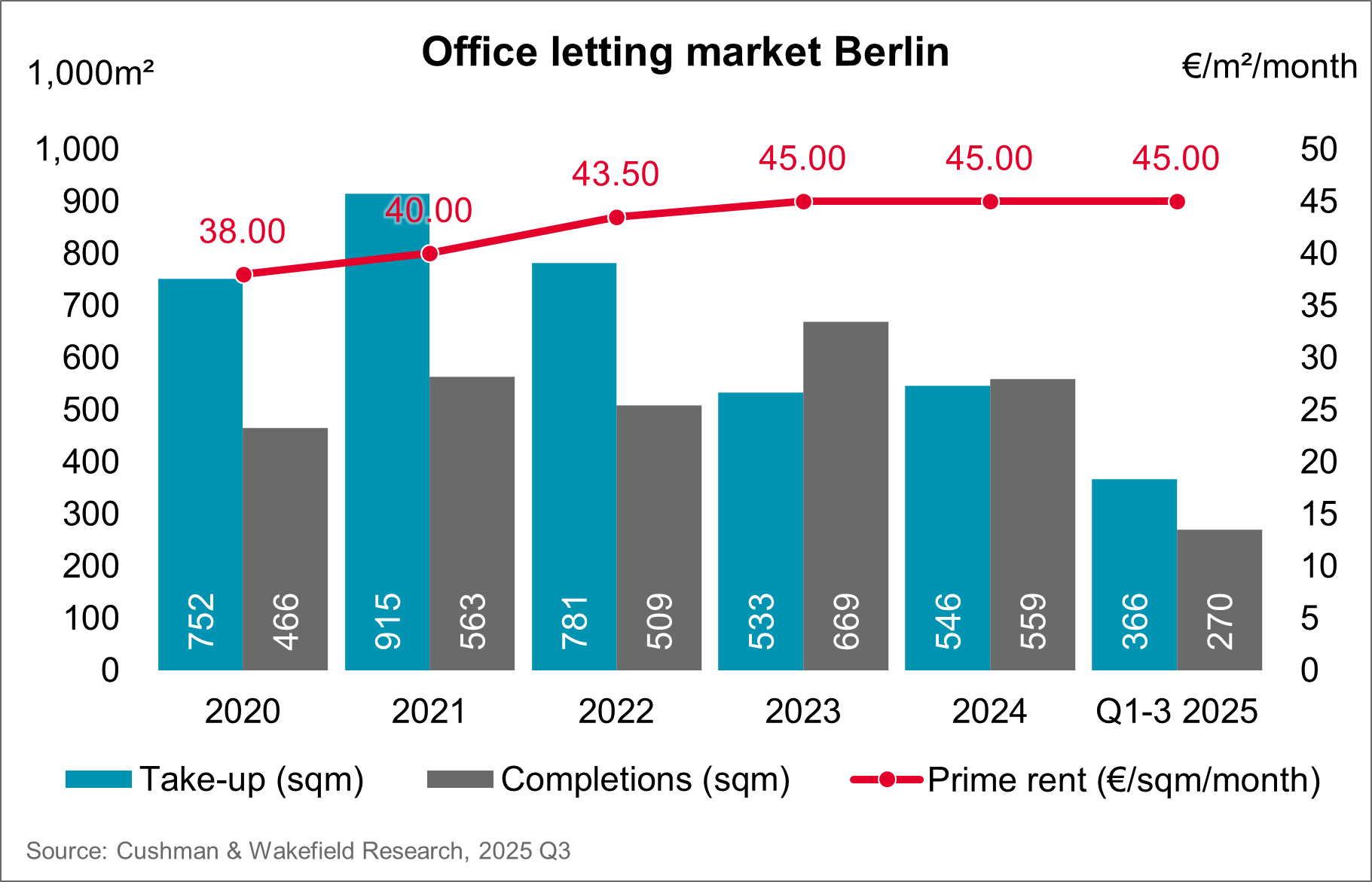

Decline in space take-up due to lack of large deals

At 366,400 m², office space take-up in the first nine months was 12 percent below the previous year and 27 percent below the 5-year average. By contrast, the number of deals rose by 19 percent year-on-year to 534, which was in line with the 5-year average.The decline in take-up is therefore attributable to the low number of large deals. Only one lease exceeded the 10,000 m² mark. This was the lease for the House of Games in the LUX Tower, covering 10,900 m², which was signed in the second quarter. There is currently a particular lack of large deals from the private sector.

Average rent falls significantly, prime rent stable

The prime rent remains unchanged at €45.00/m². Cushman & Wakefield expects this level to remain stable until the end of 2025.The average rent fell significantly for the third quarter in a row. At €26.85/m², it is 6 percent below the same quarter last year and thus at its lowest level in four years.

Vacancy rate increase slows

At the end of the third quarter, the vacancy rate, including sublet space, stood at 2.11 million m², corresponding to a vacancy rate of 9.8 percent.

The pace of increase has slowed recently as completion figures have slowed compared to previous years. Furthermore, according to our observations, the conversion of office space is no longer just an isolated phenomenon.

Vacancies increased by 47,600 m² compared with the previous quarter. This represents a significant slowdown in the rate of increase: the quarterly increase in vacancy volume was thus half that of the average for the previous two years.