Martin Höfler, Head of Office Agency Düsseldorf and Regional Manager West at Cushman & Wakefield, comments: "Space take-up in the third quarter of 2025 continues to show subdued market dynamics, which are largely influenced by the persistently low volume of leasing in the large-scale segment. At the same time, we are seeing constant demand for high-quality, ESG-compliant and, in particular, flexible office space, which is having a noticeable impact on rental price trends and is likely to continue to play an important role in turnover in the final quarter of 2025."

Large-scale leases remain rare

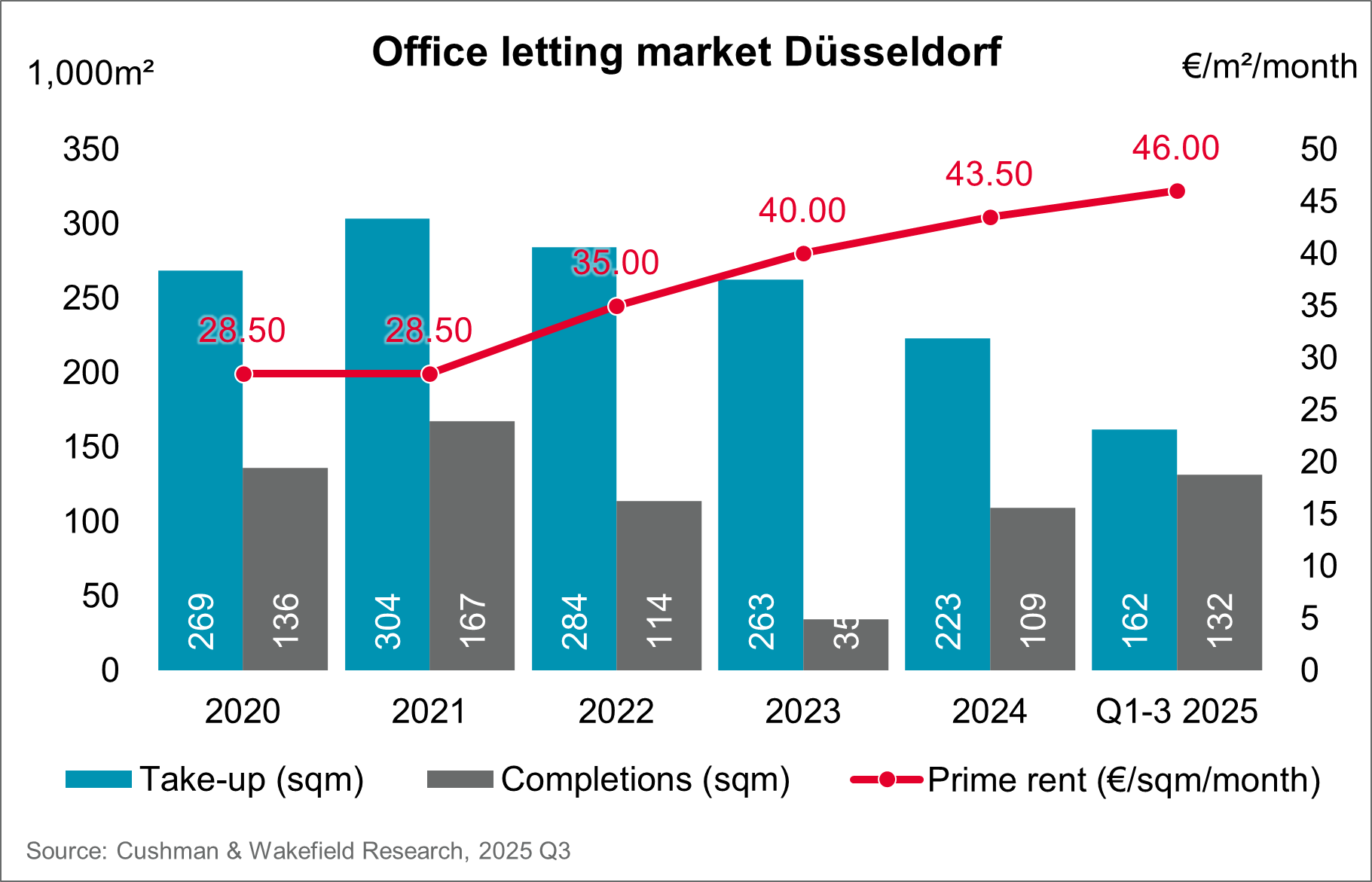

Space take-up in the third quarter of 2025 was around 58,900 m², corresponding to an increase of 7.1 percent compared with the same quarter of the previous year (Q3 2024: 55,000 m²). The cumulative take-up for the first three quarters also reflects the subdued market activity: at 162,000 m², the result is 18 percent below the 5-year average and 37 percent below the 10-year average.

Large-scale leases exceeding 5,000 m² were also completely absent from July to the end of September following the second quarter. The largest lease in the past three months was signed by the state capital of Düsseldorf, which took around 3,600 m² at Ergo-Platz 1. This means that Helaba's lease agreement for 7,800 m² in the “heylo” building, brokered by Cushman & Wakefield, remains the largest transaction so far this year. Martin Höfler: “Towards the end of the year, the current demand on the market suggests that there will be a slight upturn in leasing activity.”

Prime rents continue to rise, but at a slower pace

The achievable prime rent is currently €46.00/m², up 2.2 percent on the previous quarter. This continues the rise in prime rents seen since the beginning of the year. A further increase is expected in the last quarter of the year.

The average rent also rose due to high-priced leases and now stands at €19.80/m². This represents an increase of 2.6 percent compared to the previous quarter (Q2 2025: €19.30/m²) and 0.8 percent compared to the same quarter last year (Q3 2024: €19.65/m²).

The combination of user focus and the limited supply of high-quality, ESG-compliant office space—especially in central locations—continues to be a key driver of rental prices.

Office vacancy rates rise again, demand pressure on A-quality space increases

Office space vacancy currently stands at around 1.02 million square meters, corresponding to a vacancy rate of 10.8 percent. However, older existing space in peripheral locations is particularly affected by the rise in vacancy rates. By contrast, modern, ESG-compliant space in city locations remains competitive and is seeing stable demand.

Compared to the previous quarter (end of Q2 2025: 998,700 m² or 10.5 percent), the vacancy rate has thus risen by a further 30 basis points. Compared to the same quarter of the previous year (end of Q3 2024: 950,300 m² or 10.1 percent), this represents an increase of 0.7 percentage points.

A total of around 103,800 m² of sublet space is available in Düsseldorf. This means that supply is at the same level as in the two previous quarters (Q1 and Q2 2025: approx. 105,000 m² each) and is around 21,000 m² below the figure for the same quarter of the previous year.