Vera Passade, Head of Office Agency Hamburg at Cushman & Wakefield, comments: "The office rental market in Hamburg remains resilient in the third quarter of 2025 despite the economic challenges. The volume of transactions reflects an almost stable demand. For the year as a whole, a take-up of slightly over 400,000 m² appears to be a realistic scenario."

Large-scale owner-occupier deals and many smaller transactions characterize market activity

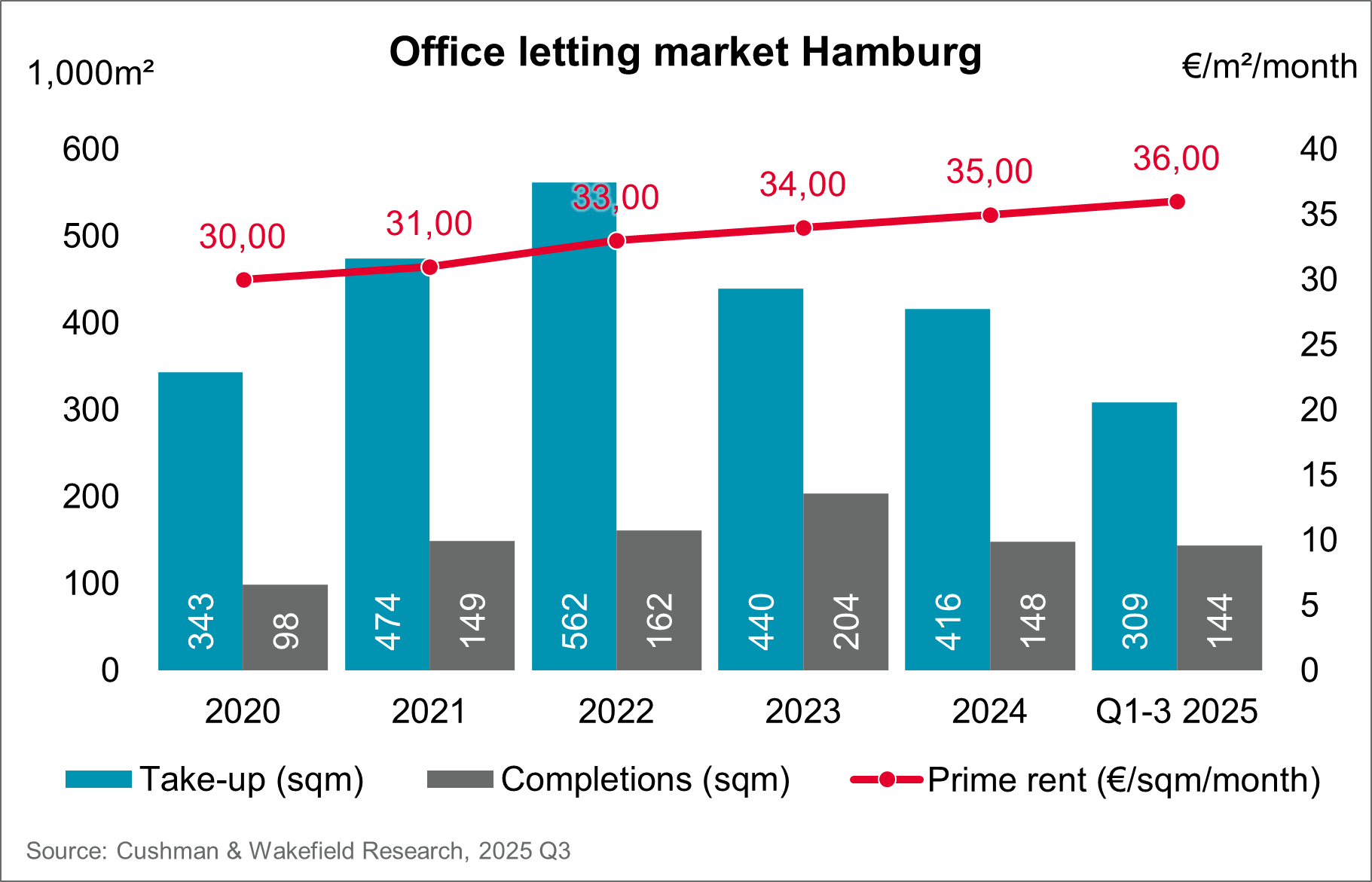

With a take-up of just under 96,000 m² in the period from July to September, the figure was slightly below the previous year's level. However, the cumulative figure of 308,900 m² (new leases and owner-occupiers) for the first three quarters is slightly above the figure for the same period last year (+4%). The number of transactions amounted to 333, which is around 15 percent below the previous year's figure.

The largest lease transaction above the 10,000 m² mark in the third quarter was concluded by NXP in Tasköprüstraße. Among the next largest deals was an international company that leased around 3,600 m² of office space in the “Überseehaus.” The transaction was brokered by Cushman & Wakefield.

In total, a sales volume of around 64,200 m² was generated in the third quarter through new leases in the size categories of 1,000 m² and above. In addition, numerous smaller deals below the 1,000 m² mark characterized market activity and totaled around 27,000 m². Owner-occupier deals accounted for around 4,600 m², or approximately 5 percent of total space turnover.

Prime rent remains stable at a high level

The prime rent remains unchanged from the previous quarter at €36.00/m²/month. The rent level is thus €1.50 or 4.3 percent higher than a year ago.

The weighted average rent rose slightly compared with the previous quarter by €0.20/m²/month to €22.20/m²/month. Year-on-year, this represents a significant increase of €1.00/m²/month or 4.7 percent.

Vera Passade: “The focus on high-quality space in central locations supported rent levels and could lead to further moderate price increases in the final quarter. ESG-compliant new buildings and modern space with high-quality fittings therefore remain one of the most important drivers of rent price development.”

Vacancy rates continue to rise – subleased space increases significantly

The vacancy rate rose to 6.4 percent in the third quarter of 2025, up from 6.1 percent in the previous quarter.

At the end of September 2025, the absolute office vacancy rate stood at 915,500 m² – an increase of around 5 percent compared to the previous quarter and 25 percent compared to the same quarter last year.

The supply of sublet space available at short notice rose by around 25 percent compared to the previous quarter and stood at 78,600 m² at the end of the third quarter. A major driver of this development is a large tenant in the HafenCity submarket, which has made its office space available for subletting at short notice.

The vacancy volume has thus been rising continuously since mid-2022. The increasing availability of space reflects the ongoing consolidation of many users.