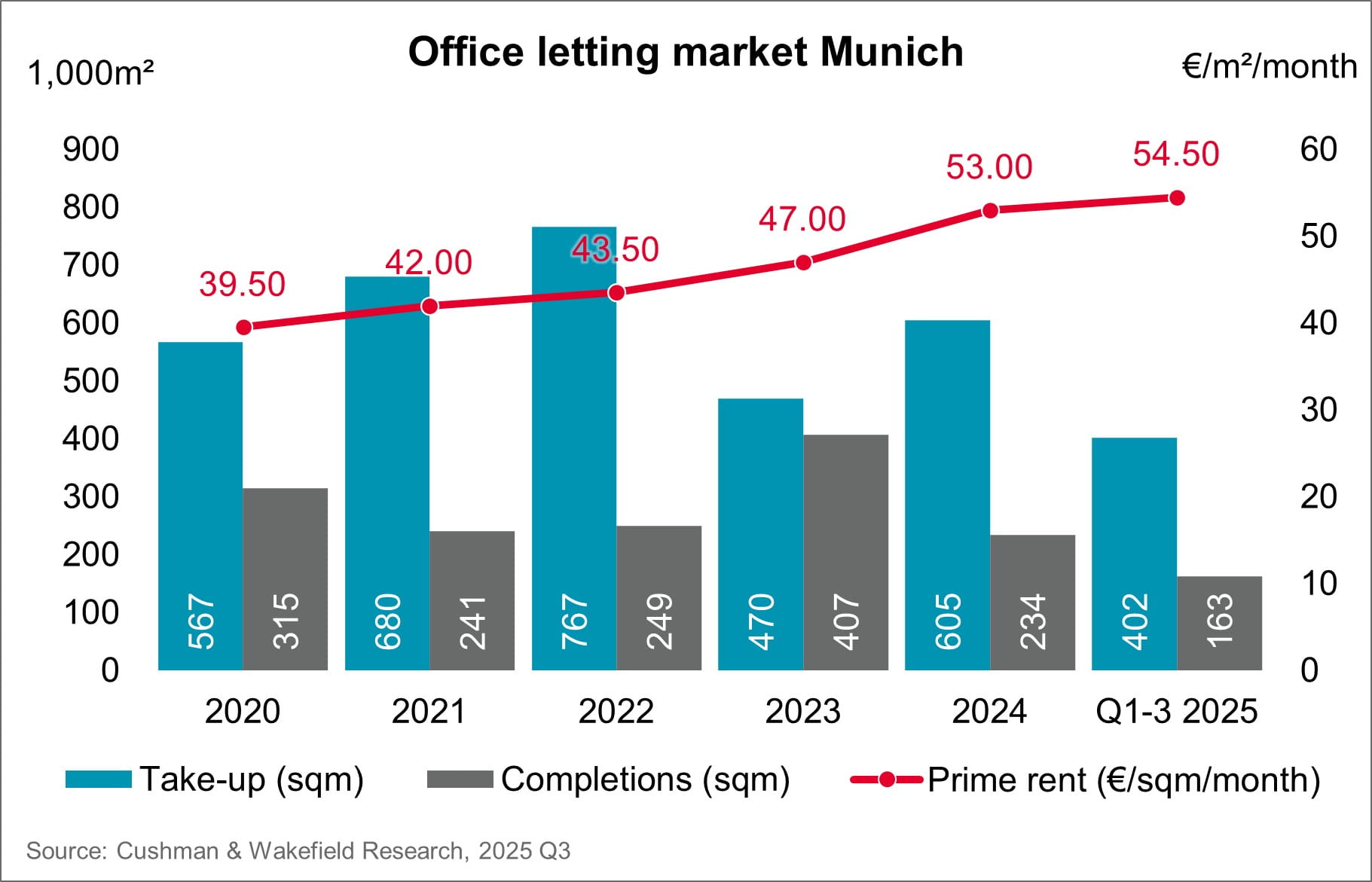

Space take-up shows strong upward trend in Q3

Space take-up in the third quarter amounted to around 140,800 m², representing an increase of around 15 per cent compared to the previous quarter (Q2 2025: 122,700 m²). This made the third quarter the strongest quarter of 2025 to date.In the period from Q1 to Q3 2025, a total of 401,600 m² of office space was let or sold to owner-occupiers. This is 9 per cent less than in the same period of the previous year (Q1-Q3 2024: 441,600 m²), and also significantly below the medium and long-term average for the first three quarters.

In the first nine months, seven deals above the 5,000 m² mark accounted for 39 per cent of space take-up. The largest deal, at 12,900 m², was a lease in the TOMORROW project in the Werksviertel district, brokered by Cushman & Wakefield.

Rental prices are moving sideways at a high level

The achievable prime rent has risen further compared with the same quarter of the previous year and now stands at £55.00/m², an increase of 5.8 per cent. The average rent of €26.00/m² represents an increase of 2.6 per cent compared to the previous year, although a slight decline has been recorded in recent months. With maximum rents now approaching the €70.00/m² mark, a further increase in rental prices is foreseeable.Vacancy rate down slightly, completions declining

Although the vacancy rate fell slightly (by 0.1 percentage points) to 8.1 per cent in the third quarter, it is still 1.4 percentage points higher than twelve months ago, i.e. at the end of the third quarter of 2024.

At the end of the quarter, a total of around 1.77 million m² of office space was available on the market for short-term rental, of which approximately 160,000 m² was sublet space.

The total volume of completions at the end of the third quarter of 2025 amounts to 633,300 m², which is 5 per cent less than in the previous year. The completed office space includes the 10,500 m² property at B.munich.