Banks and financial service providers account for one third of space take-up

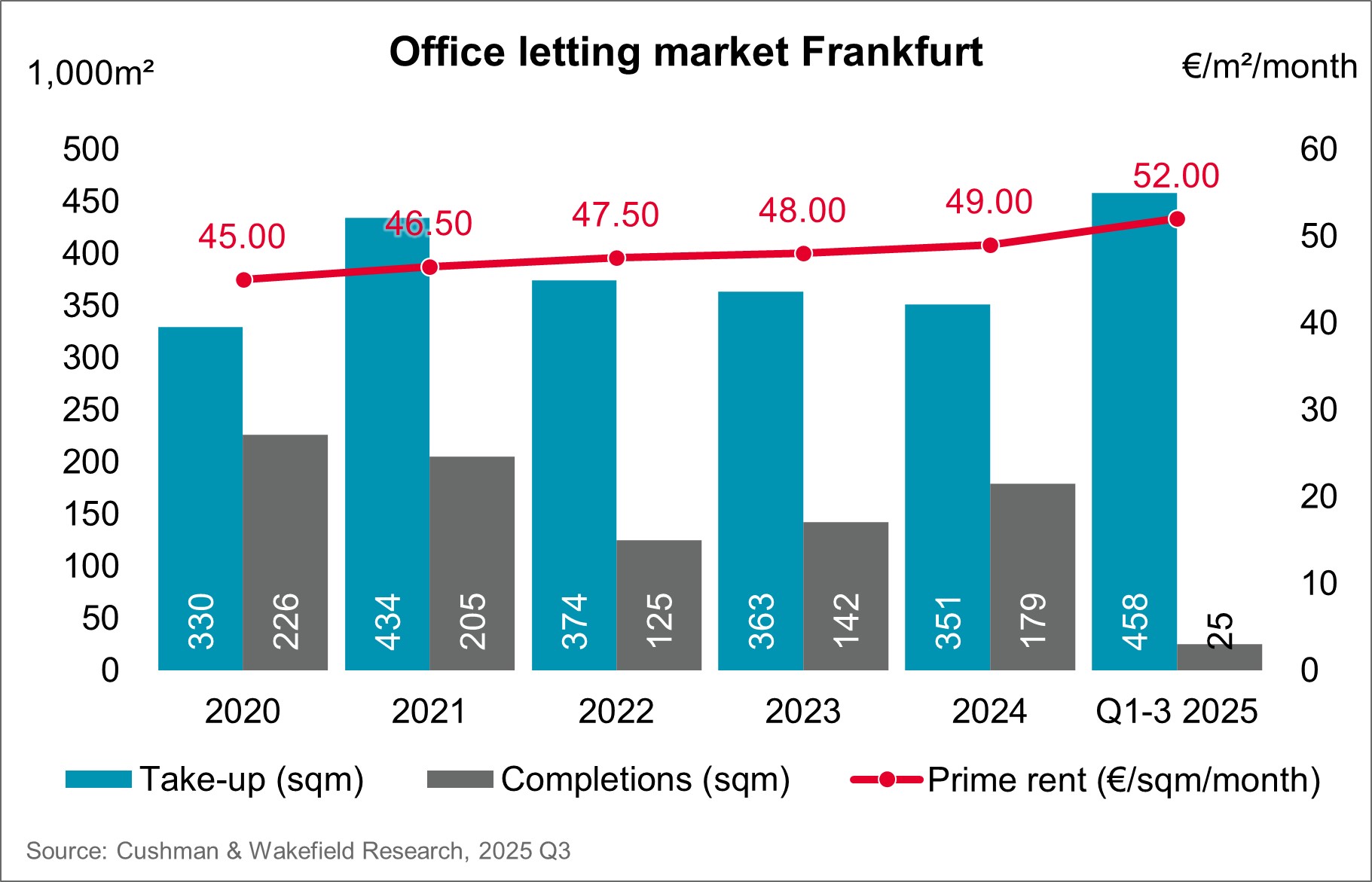

Office space take-up from new leases and owner-occupancy on the Frankfurt office rental market totalled around 458,000 m² in the first three quarters of 2025. The year-to-date result significantly exceeds the long-term averages: with an increase of 77 per cent compared to the 5-year average for the first three quarters (258,600 m²) and 46 per cent compared to the 10-year average (314,200 m²), the market is having an exceptionally strong year. This is also evident from the fact that after three quarters, the annual result for 2024 has already been exceeded by almost a third.The largest new lease so far this year remains the complete lease of the "Central Business Tower" project development by Commerzbank in the first quarter in Frankfurt's banking district, with around 73,000 m² of rental space. The largest deal in the third quarter was achieved by Allianz Global Investors as the sole tenant of the office space in the "Fürstenhof" revitalisation project, with around 17,400 m².

Banks and financial service providers have thus dominated the year to date in 2025, contributing around one third (33 per cent) of take-up with just under 151,000 m².

Prime rent at the end of the third quarter at £52.00/m²

High-priced office developments account for just under 40 per cent of space take-up. Over the past five years, the corresponding share has averaged around 20 per cent. Strong demand for high-quality space has led to a noticeable increase in rental prices. The sustainable achievable prime rent is now €52.00/m² per month, while the area-weighted average rent is €33.70/m².The prime rent has thus risen by €1.00 (+2 per cent) compared with the previous quarter and by €3.50 (+7.2 per cent) compared with the same period last year.

Compared to the third quarter of 2024, the increase in the average rent corresponds to a rise of €8.60 (+34.3 per cent). Compared to Q2 2025, it is thus €1.20 (+3.7 per cent) higher.

Vacancy rate rises to 11.5 per cent

At the end of September 2025, the office space vacancy rate stood at 1.35 million square metres. The vacancy rate of 11.5 per cent represents an increase of 1.8 percentage points compared to the same period last year and 0.4 percentage points compared to the second quarter of 2025.

Particularly peripheral submarkets such as Offenbach-Kaiserlei and Niederrad have high vacancy rates of over 30 per cent. In contrast, the CBD (banking district and Westend) has comparatively low vacancy rates of between 6 and 7 per cent.