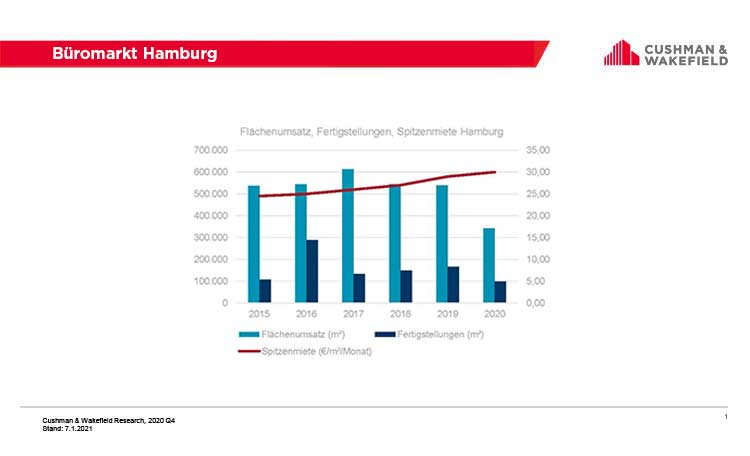

In 2020, international real estate consultancy firm Cushman & Wakefield (C&W) has recorded take-up of 343,000 square metres in the Hamburg office market. Compared to the previous year’s total of 539,000 square metres, this was a fall of 36 per cent. This is also the lowest total for the Hamburg office market area since 2003.

“In the context of the pandemic, the fourth quarter sends quite positive signals, with take-up of 93,500 square metres and a major letting of over 10,000 square metres,” commented Tobias Scharf, Head of Letting at Cushman & Wakefield in Hamburg. While Q4 2020 saw around 10 per cent less take-up than the equivalent quarter the previous year, it was the quarter with the highest take-up since the beginning of the pandemic. Although the letting market is thus reacting to the crisis with declines in demand, the commercial real estate investment market is relatively unaffected with a transaction volume of € 5.3 billion.

"Although the economic uncertainties are still having a restraining effect on the letting market, many occupiers are now able to assess the situation better than six months ago. Increasing enquiries seeking new premises and viewings testify to the beginning of a new normality," Scharf notes. Nevertheless, he expects that the coronavirus-induced slump in office letting activity could continue until at least mid-2021 due to the persistently tense economic situation. "Even though many companies are still adopting a wait-and-see attitude and delaying their leasing decisions, we are observing a strong emphasis on fit-out and the implementation of new office working environments in space searches," observed Scharf further. "These new concepts, moving away from exclusively fixed workplaces towards more collaborative spaces, could lead to an increase in demand for new office space as early as 2021," adds Marc Rohrer, Head of Capital Markets and Branch Manager of Cushman & Wakefield in Hamburg. This potential demand will be met with a slightly higher vacancy rate. Although the increase in sublet space has so far been significantly smaller than expected, Tobias Scharf expects the suspended insolvency reporting obligation and the associated risk of an increase in zombie companies to lead to an increase in office space availability due to increasing vacancy as well as additional sublet space. Given the current low vacancy level, this development will bring additional supply to a tight market environment for companies seeking space.

Large deal of 11,000 square metres saves quarterly result

While take-up in 2020 is 38 per cent below the average of the past five years, the number of lettings (476 new leases) has declined only moderately, by 10 per cent. The higher percentage decline in take-up compared to the decline in leases is due to the large number of leases under 1,000 square metres (82 per cent of leases in 2020). As lettings in this size category are only two percent below their average of the past five years, the 42 percent fewer lettings in the "larger than 3,000 square metres" segment are less noticeable.

In 2020, about 43 per cent of take-up was for space under 1,000 square metres and 25 per cent for space over 3,000 square metres. In contrast, on average over the previous five years, take-up below 1,000 square metres accounted for only 31 per cent, while 41 per cent was transacted in the over 3,000 square metres segment.

The number and total area contributed by large deals above the 10,000 square metre mark in 2020 lagged far behind the levels of previous years. There was only one large-scale deal in 2020. HCOB concluded a lease for 11,000 square metres of office space in Signa's Elbtower development project. By contrast, the previous year, 140,000 square metres of office space in total was transacted via five major deals, and on average, four major deals contributed around 105,000 square metres to take-up in each of the five preceding years. "Shortly before the end of the year, two further major deals involving around 28,000 square metres were to be signed. However, due to delays over the Christmas period, these were postponed until the beginning of 2021," explains Scharf and adds: "At the end of the year, it should be noted that larger leasing processes were gaining momentum again "

Industrial companies major source of demand, City submarket Hamburg’s most sought-after

Over the past four quarters, industrial companies made the strongest contribution to take-up. 28 deals totalling around 49,000 square metres were attributed to this sector. While the ICT sector was still the highest-turnover sector in the comparable period in 2019 with 38 new deals and a total of just over 100,000 square metres, a total of only 24,000 square metres was registered via 36 deals in 2020. This means that the ICT sector is only in sixth place in the sector ranking. Behind industrial companies, the second-largest share of take-up in 2020 falls to the public sector with: 28,000 square metres let via 14 deals.

Hamburg's City submarket (city centre), is by far the most sought-after submarket with around 89,000 square metres or a good 25 per cent of take-up. 149 leases (31 per cent) were concluded in this submarket. "When looking for new rental space, a central and easily accessible location continues to play a major role for companies," confirms Scharf. With 45,000 square metres or 13 per cent of the take-up, City South takes second place. In 2019, take-up was already focused on the City submarket, accounting for 22 per cent. However, at 11 per cent, City Süd was then only in third place behind HafenCity.

Prime rent proves crisis-resistant at € 30.00 per square metre per month

Since its increase to € 30.00 per square metre per month at the beginning of 2020, the prime rent has remained crisis-resistant and robust. Compared to the previous year's level, it has risen by 1.00 euro. Even during the crisis, the prime rent did not move below the historical € 30.00 threshold and remains stable at a sustainably achievable level. "Compared to the financial crisis, the current stability of the prime rent is primarily due to the significantly lower vacancy level. While the vacancy rate was 6.9 per cent at the end of 2008 and rose over the course of the crisis to 9.3 per cent at the end of 2010, with prime rent falling by 1.00 euro per square metre over the same period, at the beginning of the Coronavirus crisis vacancy was 3.3 per cent," analyses Helge Zahrnt, Head of Research & Insight Germany at C&W.

The weighted average rent has remained almost static year-on-year with a very slight increase. The weighted average rent across all building classes for the preceding twelve months in Hamburg was €17.45 per square metre per month at the end of 2020. Compared to the equivalent point the previous year, it had risen by € 0.10 or 0.6 per cent. The main reason for this was HCOB's large-scale lease in Signa's "Elbtower" development project.

Construction activity remains at a high level, modern space remains highly sought-after

While 155,000 square metres of completions forecast by the end of the year at the end of Q3 2020, only 98,000 square metres of modern office space was actually completed, partly due to delays in the completion of the Olympus Campus (47,000 square metres of office space).

A total of 620,000 square metres is under construction and for completion by 2025. Of this, 54 per cent has already been let. Of the space under construction that is expected to be ready for occupancy in 2021 and 2022 (475,000 square metres), 65 per cent has already been let. "The high pre-letting rates show that demand for space in development projects in good and very good locations, as well as for prestige developments remains high. An example is the leasing by HCOB in Elbtower, whose building permit application was only submitted at the end of 2020," Tobias Scharf summarises.

The largest proportions of property development projects currently under construction are in the submarkets City (149,000 square metres), City Süd (99,000 square metres) and HafenCity (92,000 square metres). In the City submarket, “Deutschlandhaus" with almost 30,000 square metres of office space is to be completed by 2023. In Überseequartier Süd in HafenCity, "Luv & Lee", "The Yard" and "Syzygal" with a total of almost 50,000 square metres are expected to be completed by 2024.

Second-best transaction volume ever recorded in the Hamburg investment market, office properties most highly sought-after

"The Hamburg office investment market proved resilient throughout the crisis year 2020. The transaction volume achieved clearly shows that pressure to invest exceeds the negative aspects of the pandemic," emphasises Marc Rohrer, Head of Capital Markets and Branch Manager of Cushman & Wakefield in Hamburg. With an investment volume of € 5.3 billion, Hamburg's commercial real estate market registered the second-highest investment result since records began increasing by 23 percent on the previous year's value. Office properties remain the most sought-after asset class accounting for 55 percent of total commercial real estate investment volume, contributing some € 2.9 billion to the annual balance sheet. "The focus of investors was primarily on core properties in central locations," notes Rohrer. "Highlight deals included the Ericus-Kontor and the Edge ElbSide in HafenCity as well as the HCOB headquarters and the Neuer Dovenhof in Hamburg city centre."

The prime yield for office properties remained stable at 2.80 per cent at the end of the year. "For 2021, we also expect continued high investment pressure in the core and also in the core-plus segment, which will also maintain the pressure on yields. Only product availability is having an increasingly inhibiting effect on investment activity, which is why the 2020 result will be difficult to match" concludes Marc Rohrer.