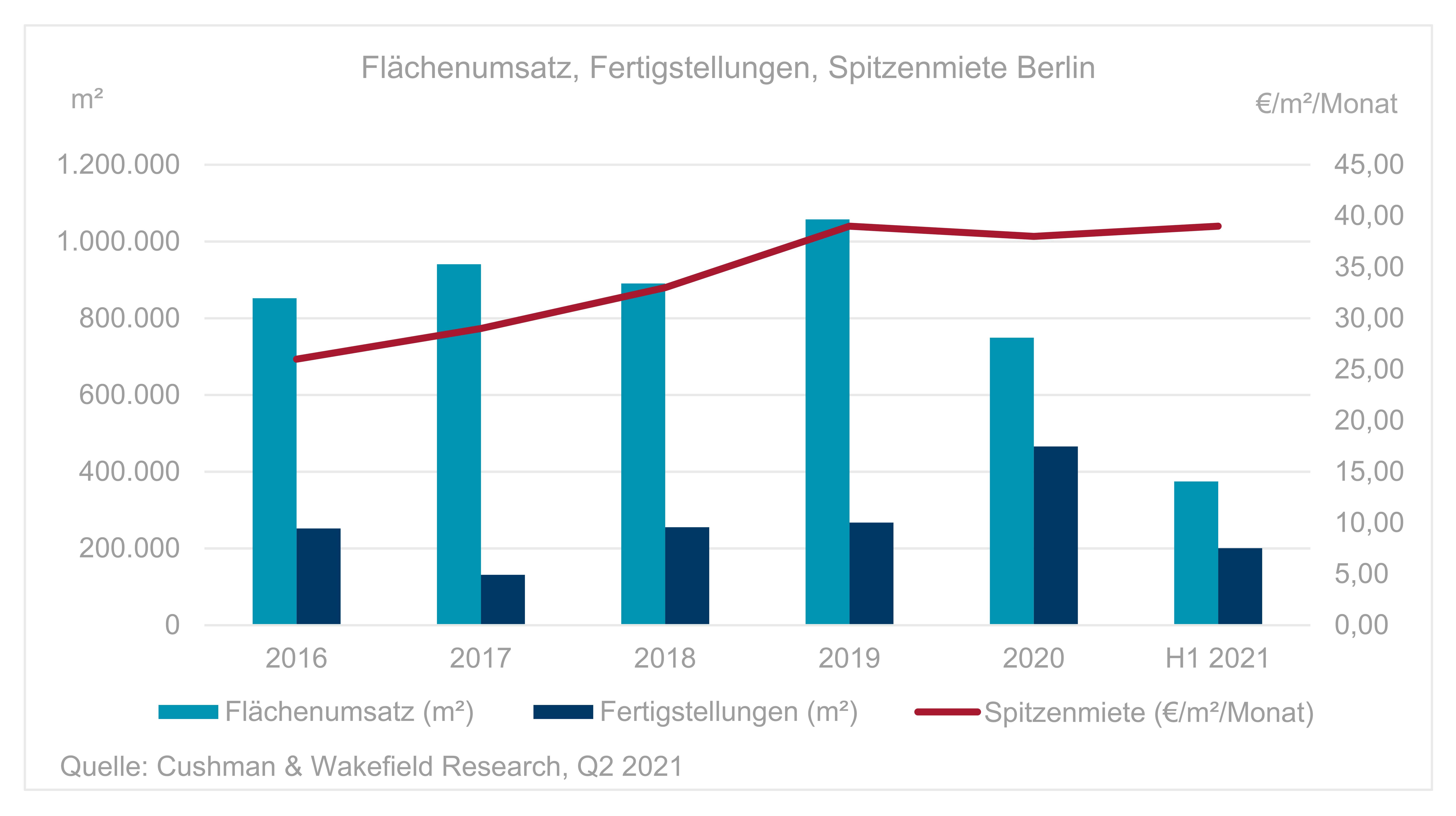

Take-up in the Berlin's office market totalled 374,800 square metres to mid-year 2021. This is 22% more than in the H1 last year. The result is around 3% below the five-year average, but around 11% above the ten-year average. In the second quarter, 176,300 square metres of space was let, slightly less than the first quarter’s 198,500 square metres. The decline is due to the fact that less space was taken up by owner-occupiers.

Public sector again responsible for large leasings

As is typical in the Berlin market, there were again large lettings to the public sector in the second quarter. The BImA Bundesanstalt für Immobilienaufgaben made the largest contribution to take-up with leases for 19,400 square metres and 14,800 square metres in two development projects. In total, 43,900 square metres or 22% of total office take-up in the second quarter was accounted for by the public sector, which thus rented more than any other sector.

With 30,300 square metres, the ICT sector and online platforms were responsible for the second-highest office take-up in the second quarter. The most significant single letting was to Home24. The company signed a lease for 13,000 square metres for the DSTRCT development project in the Prenzlauer Berg district. It is striking that all three major transactions did not take place in central office locations, but rather on or near the S-Bahn suburban rail ring.

Donn Lutz, Head of Office Agency Berlin at Cushman & Wakefield, explains: "Many companies are still working intensively on their concepts for new work structures and worlds, which include, for example, a higher proportion of remote working and desk sharing. Nevertheless, thanks to the advanced vaccination rate, it is noticeable that more of the space searches that were put on hold during the pandemic are being reactivated. We assume that in the second half of 2021 even more companies will be intensively involved in location decisions. As a result, an increase in take-up is expected."

Vacancy rate will continue to rise

At the end of the second quarter of 2021, the vacancy rate, including space available to sublet, was 3.4%. 662,500 square metres is available for immediate occupancy, 287,900 square metres or 77% more than at the same time last year. Since the beginning of the COVID-19 pandemic, availability has been steadily increasing, as the crisis has led to space reductions or subletting that is not being offset by take-up. In addition, there is space in completed development projects that is still unlet and offices in existing buildings that are becoming vacant as existing tenants move into new buildings.

68% of the available office space (451,300 square metres) is located within the S-Bahn ring. Of the total vacant space, 93,300 square metres (14 %) is available for subletting. Cushman & Wakefield assumes that the vacancy rate will continue to grow over the next two years due to the extensive development pipeline, even if the annual take-up gradually increases again towards 900,000 square metres.

Extensive project development volume

Completions in new construction and core refurbishment projects totalled 200,600 square metres in the first half of 2021, of which 78% (157,400 square metres) was already let at the time of completion. A further 477,200 square metres is expected to be completed by the end of the year, including 189,000 square metres that is still unlet. Next year, around 800,000 square metres of new office space is expected to be completed.

Development projects currently under construction total more than 1.7 million square metres. Of this, around 54% (922,000 square metres) is let or for use by owner-occupiers.

Prime rent at 39.00 euros per square metre per month

The achievable prime rent is currently 39.00 euros per square metre per month. This is one euro less than a year ago. Cushman & Wakefield does not expect any changes in the remainder of the year. The area-weighted average rent for the past twelve months is €26.50 per square metre per month, which is 3.5% lower than a year ago. Compared to the first quarter of 2021, it has fallen by 1.5 %.