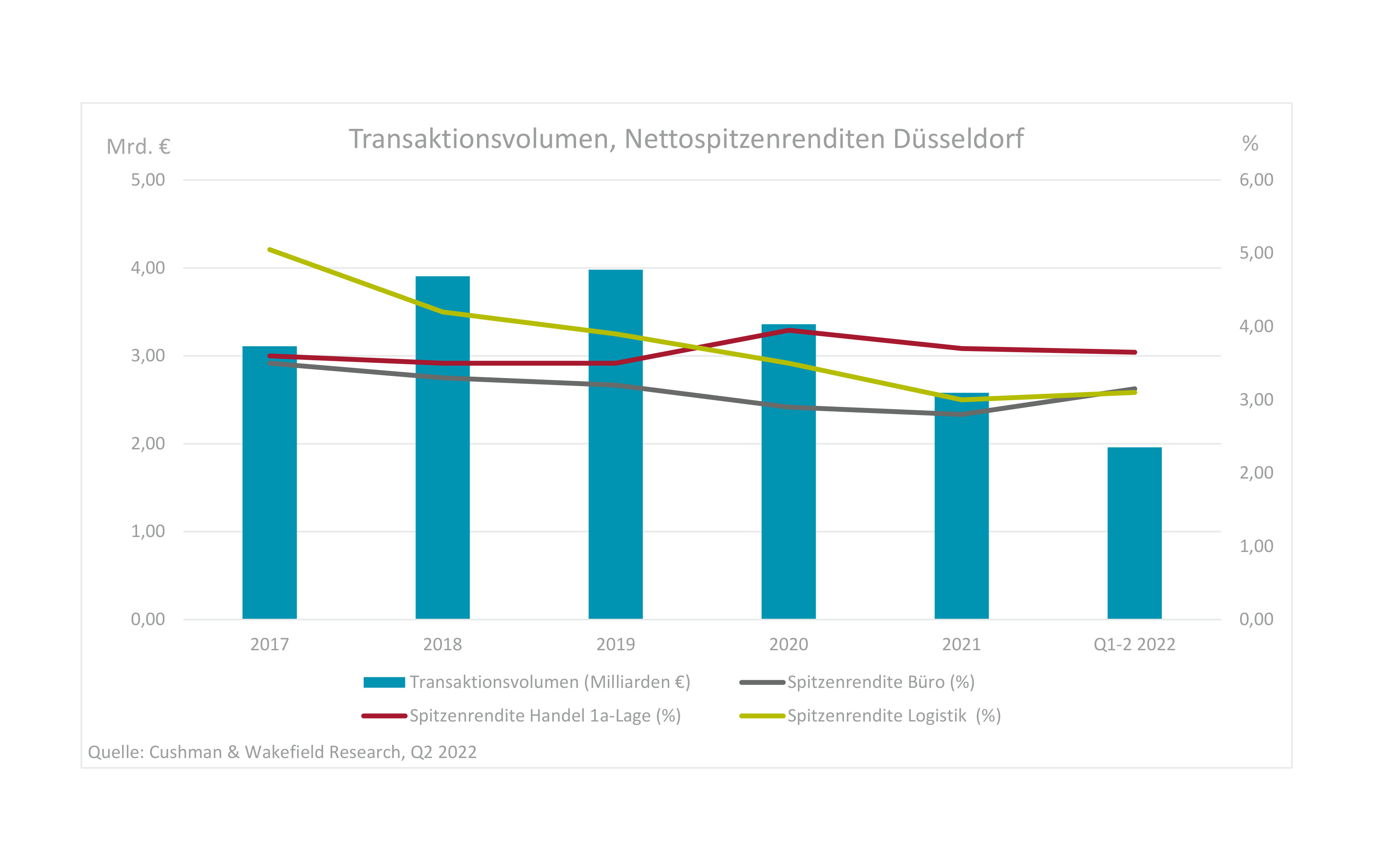

The commercial real estate investment market in Düsseldorf and its extended logistics market area achieved a transaction volume of EUR 1.96 billion in H1 2022. The was largely due to the many properties that changed hands as part of the acquisition of Alstria Office REIT. In the period April to June, transaction volume fell to around EUR 445 million, after a significantly higher result of around EUR 1.5 billion in the first quarter.

The subdued transaction momentum in Q2 2022 was triggered by sharply higher borrowing rates and geopolitical uncertainties in Europe. Compared to the previous year, the result in the 1st half corresponds to an increase of around 75 percent. The H1 5-year average was also exceeded; by almost 48 percent.

Investors prefer office properties

Office properties continue to be the clearly preferred asset class for investors, with an H1 transaction volume of some EUR 1.48 billion, more than three quarters of CRE total. However, most of the office transactions took place in the first quarter; with the second quarter only contributing around EUR 160 million. In the Düsseldorf logistics market area, which also includes the surrounding region, logistics and industrial properties achieved their strongest ever half-year transaction volume of around EUR 260 million, accounting for some 13 percent of the CRE total. The transaction volume for retail properties remains very low, contributing less than one percent of the total.

Angelo Augenbroe, Head of Capital Markets in Düsseldorf at Cushman & Wakefield, comments: "The investment market was affected by the tense situation in the financial markets particularly strongly in the second quarter. Many institutional investors are currently very concerned with the increased interest rates on borrowed capital. Sales processes have therefore come to a standstill. However, we expect the current uncertainty to subside over the summer months, buyers and sellers to find common ground again under the changed conditions and renewed momentum to develop in the market."

For 2022 as a whole, Cushman & Wakefield expects a CRE transaction volume in the region of the EUR 3.0 billion mark, which is above last year’s result.

Long yield compression phase over

The prime yield for high-quality modern core office properties has risen by 25 basis points compared to the first quarter to 3.15 percent. Here, the sharp rise in borrowing costs has had a significant influence on pricing. The purchase price bid multiples for first-class core products are currently up to five factors below the level of the previous quarters. The announced end of the current monetary policy of the European Central Bank will not contribute any easing on the financial markets in the further course of the year. It can therefore be assumed that prime yields will continue to rise.

The prime yield for prime retail properties is currently 3.65 percent. The prime yield for first-class logistics properties is 3.10 percent.