Economic stimulus package acts as stabiliser for the changing office market

Cushman & Wakefield, a global real estate consultancy, recorded office space take-up of around 531,200 m² in Germany's five most important office locations (Berlin, Düsseldorf, Frankfurt, Hamburg and Munich) in the third quarter of 2025. This is 2 per cent more than in the same period last year.

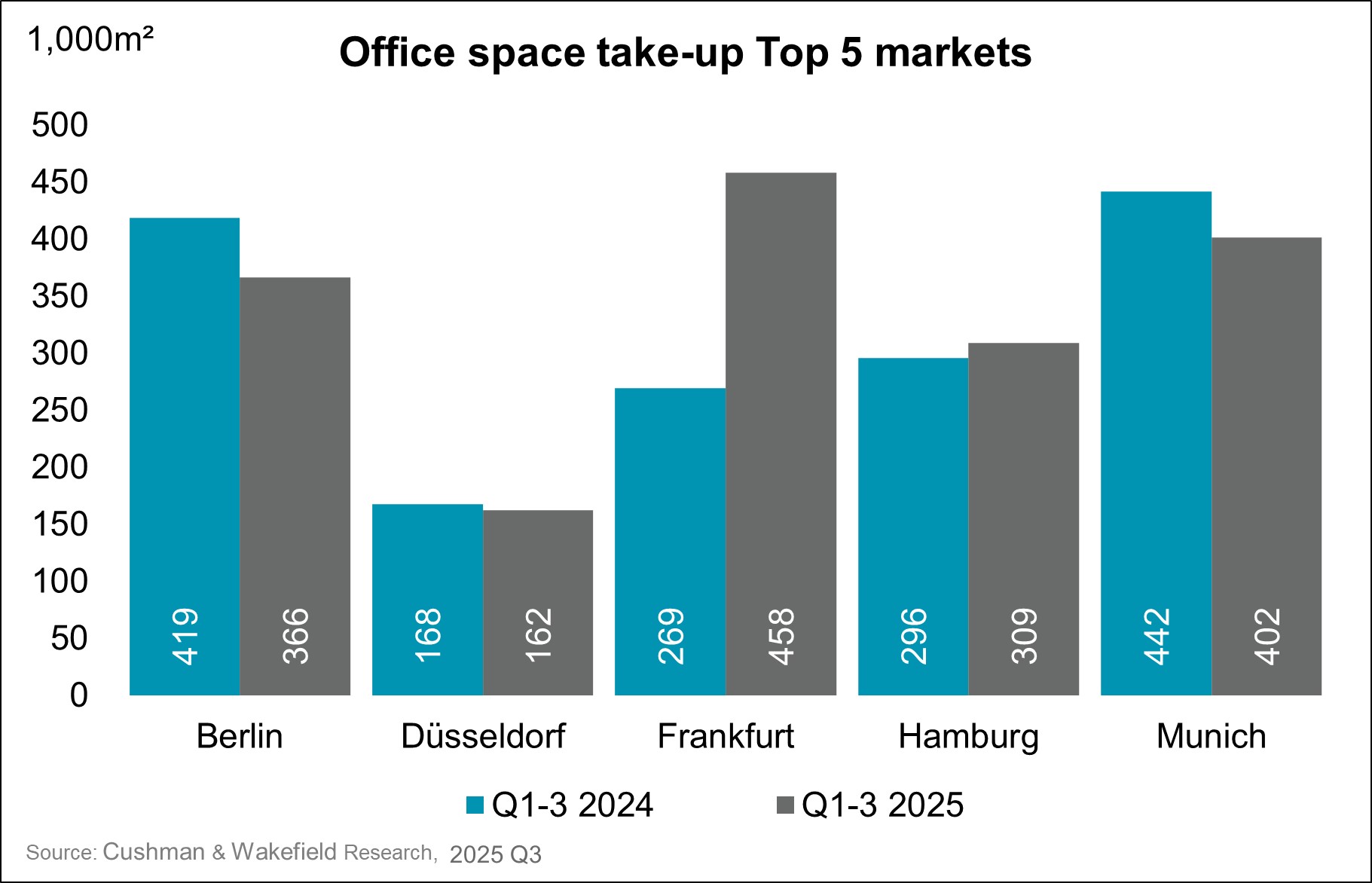

The first nine months of 2025 show an increase of 6 per cent, which is mainly attributable to the strong first quarter. A total of 1.70 million m² was recorded between January and September (Q1-Q3 2024: 1.59 million m²). However, this is 3 per cent and 18 per cent below the medium-term 5-year and long-term 10-year averages respectively.

With the exception of Frankfurt, all markets showed rather subdued momentum.

Mario Herbst, Head of Leasing & Tenant Representation Germany at Cushman & Wakefield, analyses: "In late summer 2025, Germany's economic situation is characterised by a mixture of stabilisation trends and structural challenges. After gross domestic product fell by 0.3 per cent in the second quarter of 2025 compared with the previous quarter, no major surprises can be expected for the third quarter at present. Industrial production has recently declined and the order situation in the manufacturing sector remains tense. Although retail sales have risen recently, consumer sentiment remains subdued. In addition to economic uncertainties, the weakening labour market with rising unemployment is also weighing on the economy.

Hopes remain pinned on the comprehensive economic measures announced by the German government, which should provide important positive impetus for economic growth in the coming years. The agreement in the customs dispute with the US should now give companies planning security. Accordingly, economic growth in 2026 is expected to be higher than in 2025.

"Office space take-up, as an economic indicator that reflects economic development at the corporate level, usually reacts with a delay to changes in gross domestic product. Positive economic growth leads to rising demand for office space due to expansion and new hires, while stagnating or declining GDP is accompanied by falling demand for space and consolidation processes," explains Hanjo Theiss, Head of Office Agency & Office Sector Germany, putting the situation into context.

Alexander Waldmann, Team Leader Research & Insight, adds: "The causality between GDP change and office space turnover development in the top 5 markets has a relatively high correlation coefficient of around 0.8. This means that the economic stimulus package is likely to be less of an booster and more of a stabiliser for the changing office market, thereby providing important impetus."

Office space take-up: Top 5 markets with slightly positive development

The top five office markets recorded office space take-up of around 1.70 million m² in the first three quarters of 2025. This represents a 6 per cent increase on the previous year. Among the top five markets, Frankfurt stands out with a significant increase in take-up of 457,900 m² (up 70 per cent). In Hamburg (up 4 per cent), space take-up was also above the previous year's level at 308,900 m². In contrast, Berlin (down 12 per cent) with 366,400 m², Munich (down 9 per cent) with 401,600 m² and Düsseldorf (down 3 per cent) with 162,000 m² suffered slight losses.

In the third quarter, Frankfurt once again impressed with high space take-up, remaining the most dynamic market among the top five. The take-up volume was 119,300 m², which corresponds to a 37 per cent increase compared to the same quarter last year. Düsseldorf also showed positive development with 58,900 m², while Berlin declined to 116,400 m², Munich to 140,800 m² and Hamburg to 95,800 m².

The largest deals of the quarter were in Hamburg, Frankfurt and Munich. Particularly noteworthy examples include the 17,400 m² deal by Allianz Global Investors in the Fürstenhof in Frankfurt and a 12,900 m² lease in TOMORROW in Munich. The latter deal was brokered by Cushman & Wakefield.

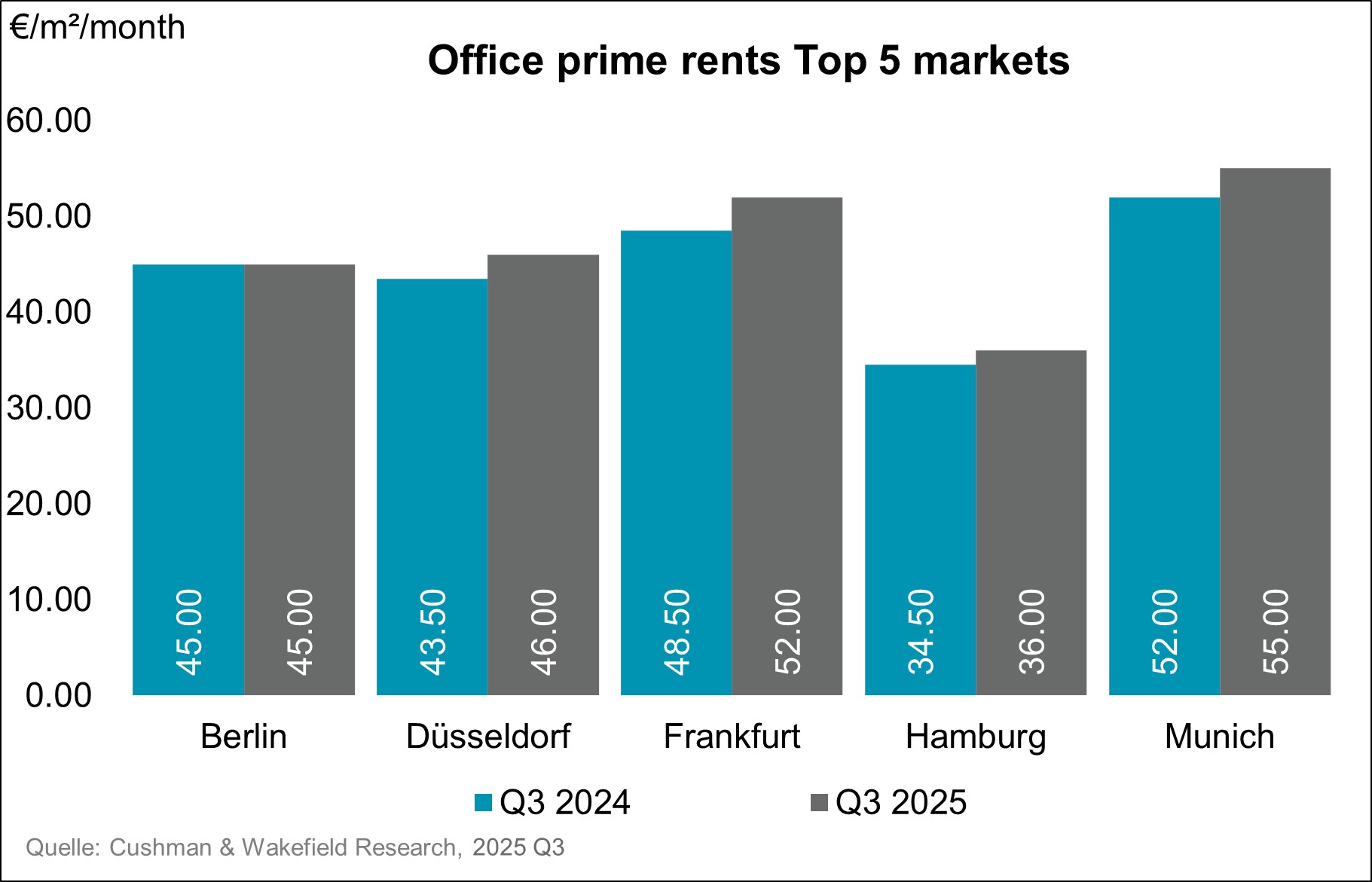

Prime rents rise – average rents mixed

Prime rents continued to rise in almost all markets. In Frankfurt, the prime rent rose to €52.00/m², representing an increase of 7.2 per cent year-on-year. Düsseldorf, Hamburg and Munich also recorded significant increases, while Berlin stagnated. This puts them at €45.00/m² in Berlin, €46.00/m² in Düsseldorf, €36.00/m² in Hamburg and €55.00/m² in Munich. Compared with the previous quarter, these prime rents also reflect increases in Frankfurt and Düsseldorf. In the other top five markets, prime rents remain at the previous quarter's level.

The picture for average rents is more mixed: Frankfurt led the way with a 34 per cent increase to €33.70/m² in a 12-month comparison due to high-priced transactions. Munich, Hamburg and Düsseldorf also saw increases in average rents compared with the same period last year. Berlin, on the other hand, recorded a decline of 6.3%.

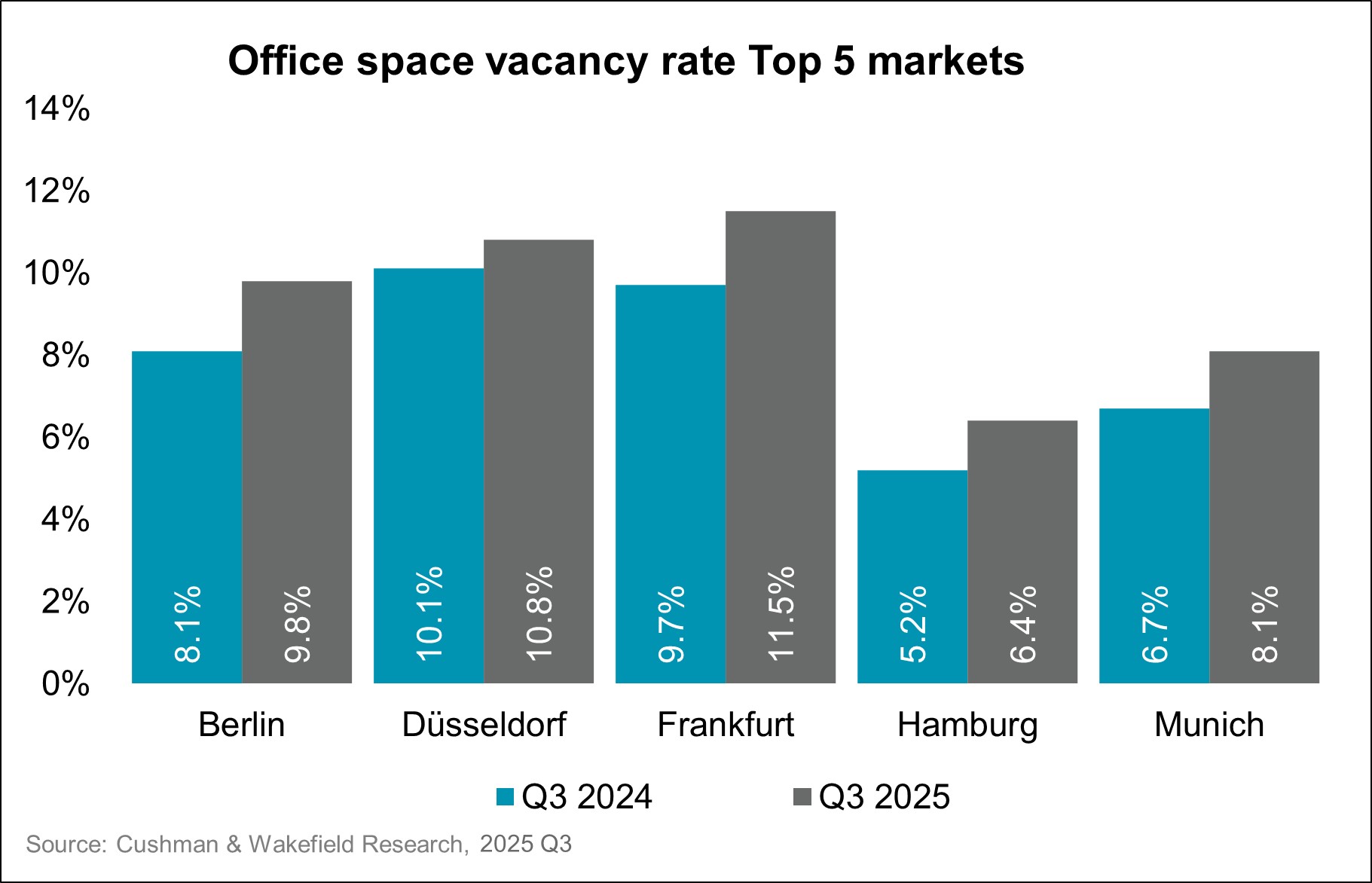

Vacancy rates: increase in all markets

Vacancy rates in the top five markets have risen further and now stand at an average of 9.1 per cent. This represents an increase of 0.2 percentage points quarter-on-quarter and 1.4 percentage points year-on-year. In total, 7.16 million square metres of office space is currently available on the market in the top five cities (an increase of 1.16 million square metres compared with the end of Q3 2024). With the exception of Düsseldorf, all markets have seen an increase in vacancy rates of more than 1.0 percentage points over the last 12 months. Frankfurt currently has the highest vacancy rate at 11.5 per cent, followed by Düsseldorf at 10.8 per cent, while Berlin continues to approach the 10 per cent mark at 9.8 per cent.

Construction activity declining – Berlin and Munich dominate

Completions in the third quarter of 2025 confirm the downward trend. A total of 258,900 m² of new office space was completed – a decline of 19 per cent compared to the same period last year. Berlin and Munich remain the most active markets, while Frankfurt once again has a very low completion volume of 16,300 m². For the first nine months, the completion volume in the top 5 markets amounts to 733,500 m², which is one-fifth below the previous year and the average for the last 5 years.

At the end of September, around 2.77 million m² of office space was under construction in the top five markets, the lowest construction volume in the last eight years. 54% is still available on the market. Among the markets, Berlin has the highest construction volume at the end of September 2025 with 957,400 m², followed by Munich with 633,300 m² and Hamburg with 459,800 m². The occupancy rate of the space under construction in these markets ranges from 45 to 65 per cent.