- Cushman & Wakefield’s flagship global retail report Main Streets Across The World focuses on headline rents in best-in-class urban locations, many linked to luxury sector

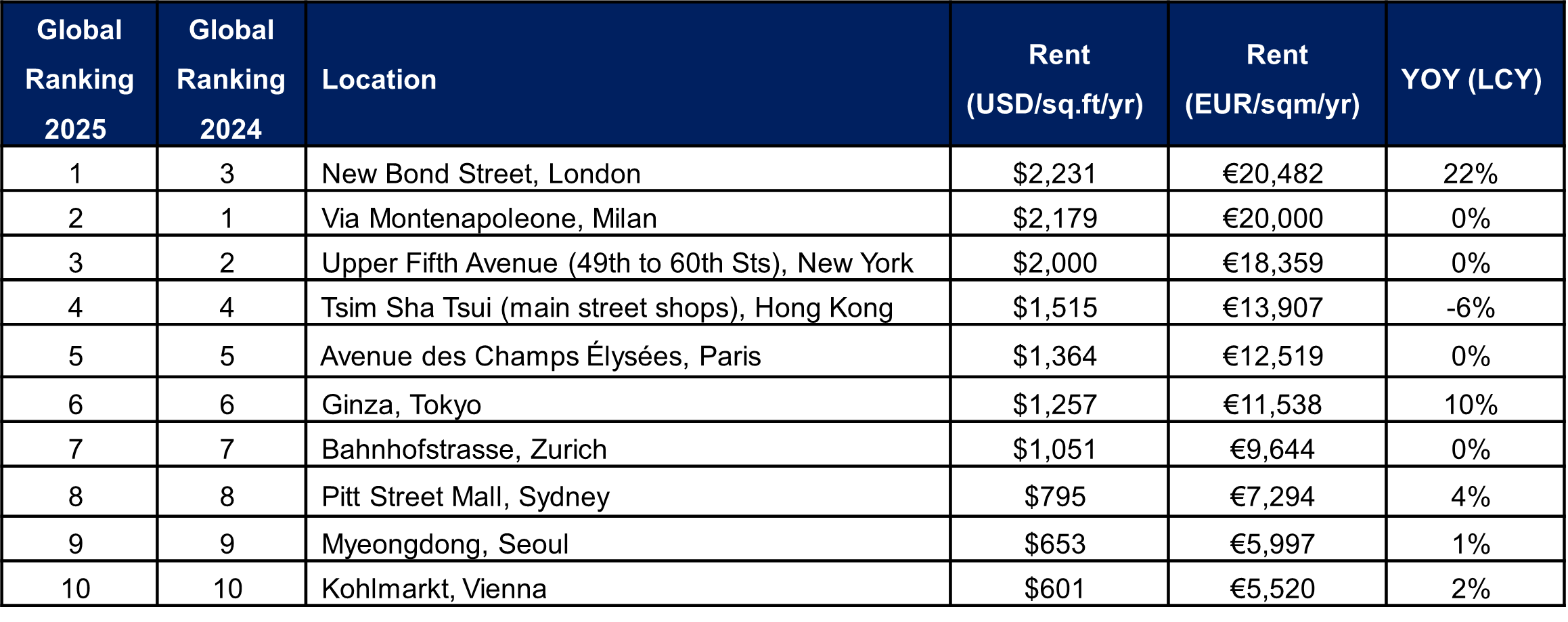

- In its 35th edition, rents on New Bond Street ($2,231 per square foot per year) have leapfrogged Milan’s Via Montenapoleone and New York’s Upper Fifth Avenue to top the global rankings

- 58% of tracked retail streets saw rent increases, reflecting demand for space far exceeding availability

London’s New Bond Street, where rents have risen by 22% in the past year to $2,231 per square foot per year (psf/yr), has been crowned the world’s most expensive retail destination for the first time, according to Cushman & Wakefield (NYSE: CWK).

New Bond Street has leapfrogged Milan’s Via Montenapoleone ($2,179 psf/yr), which last year became the first European street to top the global rankings, and New York’s iconic Upper Fifth Avenue ($2,000 psf/yr), in the 35th edition of the firm’s flagship retail report ‘Main Streets Across the World’.

New Bond Street’s rental growth has been fuelled by strong demand and limited supply, with the prime jewellery section between Clifford Street and Burlington Gardens becoming one of the most fiercely contested locations in global retail.

Globally, rents grew on average at 4.2% with 58% of markets experiencing rental growth. The Americas led regional rental growth at 7.9%, driven by currency effects in South America. Europe experienced steady 4% year-on-year (y-o-y) growth, with standout performances in Budapest and London. Meanwhile rents in Asia Pacific slowed to 2.1%, with strong growth in India and Japan offset by economic headwinds in Greater China and Southeast Asia.

Report author and Cushman & Wakefield’s Head of International Research, Dr. Dominic Brown, said: “Prime retail corridors are benefiting from a convergence of factors including resilient economic growth, easing cost of living pressures, and a renewed appetite for discretionary spending. While growth trajectories will vary by market, the strength of flagship locations is clear. We’ve seen exceptional double-digit rental growth in select cities, even as others face pressure. The continuing importance of physical retail, particularly for deep and meaningful brand engagement in places where consumers want to be, reinforces the enduring appeal of the world’s premier shopping streets and we expect this momentum to strengthen as global conditions improve.”

Main Streets Across the World – Global Ranking by Market 2025

Source: Cushman & Wakefield

Asia Pacific Highlights

Rental growth in Asia Pacific slowed from 2.8% in 2024 to 2.1% in 2025, though performance varied widely across markets. India’s Tier 1 cities led the region, with Gurgaon’s Galleria Market recording a 25% increase, followed by Connaught Place in New Delhi (14%) and Kemps Corner in Mumbai (10%). Japan’s Ginza and Omotesando in Tokyo saw strong growth of 10% and 13% respectively, while rents in Hong Kong’s Tsim Sha Tsui declined by 6% to $1,515 psf/yr. Sydney’s Pitt Street Mall recorded modest growth of 4%, reaching $795 psf/yr, marking a return to positive momentum after years of stagnation.

Cushman & Wakefield’s Asia Pacific Head of Retail Sales & Strategy Sona Aggarwal, said: “Asia Pacific retail is demonstrating resilience despite economic challenges. India, Korea and Japan are leading growth with strong demand and premiumisation. Confidence is picking up in Singapore and Sydney, with rents inching higher. Vietnam and parts of Greater China remain a little soft due to geo-political and economic headwinds. On balance, shifting shopper habits and highly adaptive retailer strategies driving innovation in “phygital” experiences keep our dynamic region poised for long-term growth."

Main Streets Across the World – Asia Pacific Ranking by Location 2025

Source: Cushman & Wakefield

Dan Kim, Deputy Managing Director, C&W Korea says ““Myeong-dong stands as Korea’s leading mega commercial district, at the forefront of K-Culture and the K-Wave. Its exceptional wide-area transportation network, combined with abundant hotel and office infrastructure, supports a strong and diverse demand base that includes both international tourists and local professionals. The curated mix of K-content brands - spanning K-Fashion, K-Beauty, and K-Clinic - naturally encourages longer visits and overnight stays, while the rise of flagship stores continues to attract younger consumers.”

He adds “Its strategic proximity to the Central Business District (CBD) also contributes to stable sales by drawing in office workers. Powered by this virtuous cycle of cultural appeal and robust infrastructure, Myeong-dong consistently achieves the nation’s lowest vacancy rates and highest rental yields, solidifying its status as a global mega high street.”

Notes to Editors:

- Link to the full report and full global rankings here: https://digital.cushmanwakefield.com/mainstreets-11-2025-global-central-en-content-retail/

- Using Cushman & Wakefield’s proprietary data, the annual Main Streets Across the World report focuses on headline rents in 141 best-in-class urban locations across the world which, in many cases, are linked to the luxury sector. It includes a global index ranking the most expensive destination in each market.

- Rental growth has been calculated in local currency and converted into US$/EUR€ to present a standardised global ranking.

- In locations where rental levels are usually reported as Zone A rents (United Kingdom, Ireland, Denmark and France), the rents in the main body of the report have been standardised to compare with other geographies.