Hanoi, 28th Jan 2026 – Cushman & Wakefield announced its Q4 2025 Hanoi Residential MarketBeat Report, highlighting a continued shift toward suburban locations across both the apartment-for-sale and landed property segments, as the market rebalances following a period of strong growth. New residential launches in Q4 2025 were largely concentrated in suburban areas, supported by improving infrastructure, integrated township development, and more competitive pricing compared to core districts.

“Across both apartments and landed housing, Hanoi’s residential market is clearly entering a more mature phase, where location quality, infrastructure connectivity, and product positioning are becoming more important than volume-driven expansion,” said Ngoc Le, Senior Director, Strategic Consulting, Cushman & Wakefield Vietnam. “While launch activity moderated in late 2025, demand has remained resilient for well-planned suburban projects, particularly those offering integrated amenities, transparent legal status, and long-term liveability.”

Apartment- for- sale market: a sustained recovery

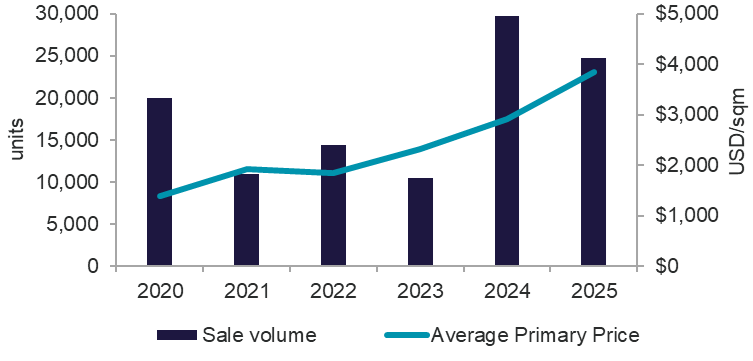

In 2025, Hanoi’s apartment market recorded approximately 24,500 new units launched, down 14% YoY but still nearly three times higher than 2023. In Q4 2025, new supply increased 34% QoQ, though remained 32% lower than the same period last year, indicating a more measured pace of launches.

New Supply & Future Supply Q4 2025

Source: Cushman & Wakefield

Most new supply was concentrated in Suburban areas, supported by improved transport infrastructure, abundant land reserves, and more competitive pricing compared to core urban districts. Mid-end apartments dominated with a 45% share, reflecting strong end-user demand and affordability. High-end units accounted for nearly 40%, concentrated in projects with prime locations and comprehensive amenities, while the affordable segment remained absent.

Hanoi recorded nearly 6,200 units sold in Q4 2025, up 2% from Q3 2025, signaling short-term stability. However, transactions fell 33% YoY, reflecting a market adjustment following a period of strong growth. Despite this, absorption remained 31% higher than Q4 2023, highlighting a significant recovery from previous lows. Additionally, the ongoing shift toward suburban areas with improved connectivity continues to support demand, particularly for projects offering comprehensive amenities and clear construction progress.

Market Performance Q4 2025

Source : Cushman & Wakefield

Note: The average primary price is calculated based on NLA, exclusive of VAT and maintenance fee

USD/VND Exchange rate in Q4 2025 = 26,500

Average primary prices in Q4 2025 stood at approximately USD 3,852 per sqm, down 10% QoQ but up 32% YoY. The quarterly decline was driven by a higher proportion of mid-end units, which accounted for nearly 45% of new supply, pulling overall prices down. However, prices remain significantly higher than last year’s levels, underscoring a long-term upward trend fueled by rising input costs (land and construction materials) and limited supply in core urban areas.

In 2025, Hanoi added around 6,000 new apartments, bringing total annual supply to over 24,000 units, largely concentrated in non-central areas benefiting from urban expansion plans and infrastructure development. Between 2026 and 2028, the market is expected to welcome more than 68,000 new units, reinforcing the shift toward satellite zones. This trend reflects strategic urban decentralization and developers’ long-term approach to capture population movement and real housing demand. Increased competition among large-scale projects is anticipated, focusing on amenities, product quality, and pricing—particularly as buyers prioritize green living spaces, integrated infrastructure, and sustainable value.

Landed property market: the strongest absorption in six years

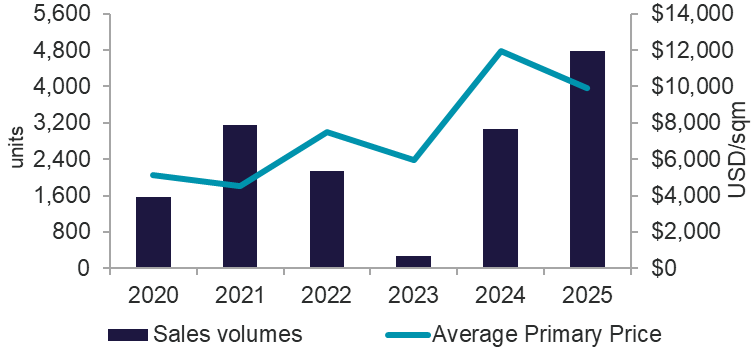

In 2025, Hanoi’s landed property market recorded approximately 3,500 new units launched, down 10% YoY but still the second-highest level after 2024. In Q4 2025, supply reached over 220 units, a slight increase of 3% compared to the previous quarter but a sharp decline of 87% YoY. This drop was primarily due to Q4 supply being driven by small-scale projects in the suburban area, with no major integrated township projects launched. Most new supply was concentrated in non-central locations, reflecting a clear shift in urban development strategies toward Suburban areas with abundant land reserves. Developers are prioritizing areas with strong infrastructure investment, convenient transport connectivity, and high population growth potential in the near future. This trend underscores the market’s transition toward satellite city development, aiming to meet housing demand while offering quality living spaces and integrated amenities.

New Supply and Future Supply Q4 2025

Source: Cushman & Wakefield

The average primary selling price is calculated based on Gross Floor Area (GFA), exclusive of VAT and maintenance fees.

The USD/VND exchange rate at Q4 2025 = 26,500.

In 2025, Hanoi’s landed property market recorded nearly 4,800 units sold, the highest level in six years since 2020, driven primarily by strong absorption in large integrated townships located in suburban areas. However, in Q4 2025, transactions reached over 200 units, down 64% QoQ and 77% YoY, mainly due to limited supply during the quarter. Notably, most transactions occurred in projects that combined key factors such as strategic location, transparent legal status, comprehensive amenities, and reputable developers, reflecting buyers’ growing preference for quality and long-term value.

In Q4 2025, Hanoi’s average primary price stood at approximately USD 9,917 per sqm, down 8% QoQ and 14%YoY. This adjustment was primarily driven by new supply at more competitive price points in suburban districts such as Hoai Duc and Thach That. These areas are benefiting from urban expansion plans, infrastructure development, and abundant land reserves, enabling developers to offer products at more attractive prices. This trend not only diversifies options for buyers but also reflects the market’s strategic shift toward peripheral zones with strong long-term growth potential.

Market Performance Q4 2025

Source: Cushman & Wakefield

The average primary selling price is calculated based on Gross Floor Area (GFA), exclusive of VAT and maintenance fees.

The USD/VND exchange rate at Q4 2025 = 26,500.

In the medium term (2026–2028), landed property supply in Hanoi is projected to reach approximately 10,800 units, primarily concentrated in suburban areas. This shift reflects an inevitable trend as inner-city land becomes increasingly scarce, aligning with the city’s strategy to develop satellite towns to ease population pressure and reduce infrastructure strain on the urban core. Future projects are expected to focus on integrated township models featuring comprehensive amenities, transparent legal frameworks, and strong transport connectivity.