Insights

Most Recents

Research

APAC Data Centre Update: H2 2025

Marketbeats

MarketBeat • Workplace

Economy

Podcast • Economy

Cushman & Wakefield: Behind the Numbers

Research • Economy

Six for 2026: Real Estate Trends to Watch in Asia Pacific

Article • Economy

James Bohnaker • 26/06/2025

Research • Economy

Rebecca Rockey • 30/04/2025

Research • Economy

Rebecca Rockey • 28/04/2025

Logistics & Industrial

Research • Labor / Talent

Americas Industrial Labor Insights

Insights

Driven by major geopolitical and economic developments, governments across Europe are reshaping policies focused on defence, sustainability, and supply chain security. For industrial real estate, the implications are clear: demand for specialist industrial and logistics assets is set to accelerate.

Insights • Supply Chain

Edward Bavister • 04/08/2025

Data Centres

Research

H2 2025 EMEA Data Centre Market Update

Research

APAC Data Centre Update: H2 2025

Office

Research

Reimagining Workplaces: Why Efforts Fall Short—and How to Get It Right

Research • Workplace

15/09/2025

Workplace

Research • Workplace

Despina Katsikakis • 17/06/2025

Sustainability

Research • Sustainability / ESG

Industrial Logistics Climate Risk Outlook

STAY TUNED FOR THE LATEST MARKET INSIGHTS AND UPDATES

GLOBAL MARKET REPORTS

Research

Logistics & Industrial: Monthly Trends & Insights

Research

AI Impact Barometer: Conviction in a Transforming World

Research

H2 2025 EMEA Data Centre Market Update

Research • Supply Chain

Greater China Logistics Market Q4 2025

MarketBeat

Research • Economy

FEATURED ARTICLES

Research

APAC Data Centre Update: H2 2025

Insights

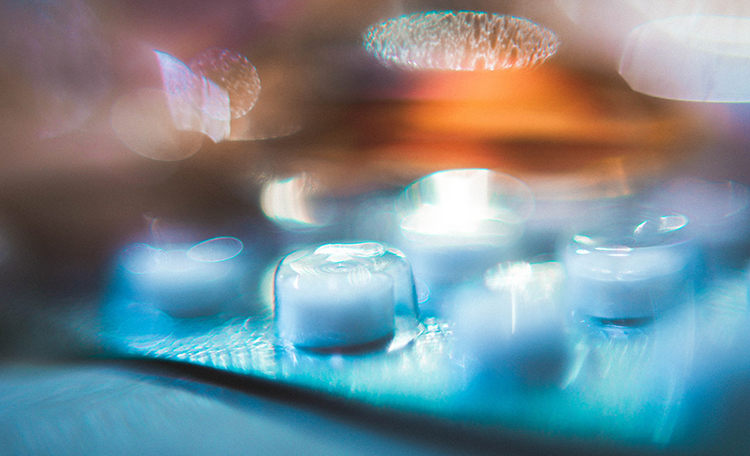

Japan's Pharmaceutical Cold Chain is Facilitating the Supply of New Drugs and Vaccines

The pharmaceutical cold chain has experienced increasing demand in recent years due to rapid developments in biopharmaceuticals and regenerative medicine, a trend that looks set to grow with the rollout of vaccines and other treatments for COVID-19.