Services

Capital Markets

Relentlessly focused on long-term value

Around the world and across asset classes, our Capital Markets advisors deliver intelligent capital strategies that drive better outcomes — every deal, every time.

We connect clients with unrivaled access to active capital sources, delivering creative solutions that drive better returns. Beyond any single transaction, we build relationships that endure through cycles, across continents and over time. That's why more investors are turning to us as their advisor of choice. Our deep understanding of U.S. market dynamics positions us to navigate the complexities of commercial real estate investment with precision and expertise.

What Sets Us Apart

Access to Active Capital

No matter what the market conditions, we have deep relationships with active capital across the globe to maximize value for our clients. Our extensive network includes institutional investors, private equity funds, REITs, and high-net-worth individuals who are actively seeking quality investment opportunities in the U.S.

Creative Capital Solutions

With a deep bench of capital sources, complex structuring experience and access to a full spectrum of financial services, we create bespoke solutions across all asset classes to give our clients an edge. From traditional acquisitions to sale-leasebacks, joint ventures, and forward funding arrangements, we structure deals that align with your specific objectives and market conditions.

Research & Insights

Our insights support our clients in navigating the cycles through market attractiveness, modeling and forecasting analysis. We thoughtfully advise by interpreting the structural changes happening across the built environment, including the evolution of workplace dynamics, e-commerce impacts on retail, and the growth of logistics infrastructure across America.

Proprietary Investor Data & Technology

Our advisors combine data, intelligence and local market knowledge in our proprietary investor-focused technology platforms to enhance the performance of investments and make smart decisions for the future, for any asset type across the globe.

Market Leadership & Recognition

Our track record spans the most active markets across America, from gateway cities like to high-growth secondary markets including. Whether facilitating landmark sales, arranging creative financing, or executing complex recapitalizations, we help clients seize opportunities and shape what comes next in their investment journey.

Specialization

Industry-Focused Service Portfolio

Office

We provide strategic guidance for office investors navigating this transformation, from core CBD properties to suburban flex spaces and mixed-use developments. Our team understands the nuances of different metropolitan markets, from the established financial districts of New York and San Francisco to emerging tech hubs in Austin and Nashville. We help clients identify value-add opportunities, reposition assets for modern tenants, and capitalize on the flight-to-quality trend driving demand for premium office spaces.

Industrial

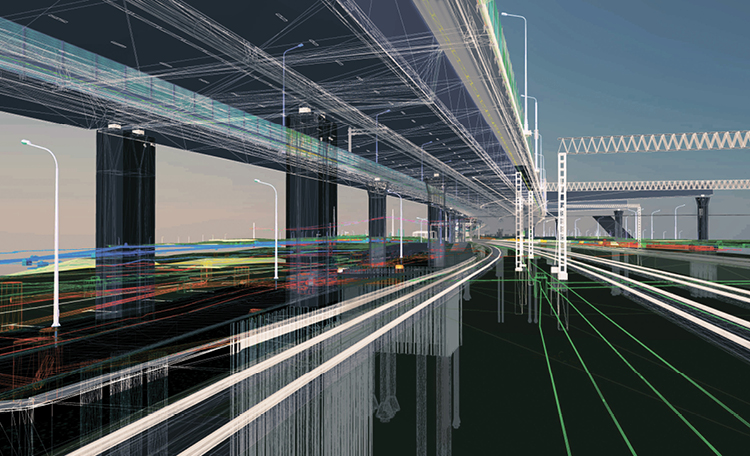

We specialize in identifying and executing transactions across the full spectrum of industrial assets, from last-mile distribution centers in dense urban markets to large-scale fulfillment facilities and manufacturing sites. Our expertise spans emerging markets like the and established logistics corridors along major transportation networks. We understand the critical factors driving industrial investment success, including proximity to population centers, transportation infrastructure, labor availability, and evolving tenant requirements for modern, efficient facilities.

Learn more about Logistics & Industrial Investment

Land & Development

We provide comprehensive advisory services for land investors, from raw land acquisition to entitled development sites and build-to-suit opportunities. Our expertise covers residential development sites in high-growth markets, mixed-use opportunities in transit-oriented locations, and industrial land in strategic logistics corridors. We help clients evaluate development feasibility, understand local regulatory environments, and structure transactions that optimize risk-adjusted returns throughout the development cycle.

Learn more about Land & Development Investment

Retail

We guide retail investors through this dynamic environment, focusing on assets that demonstrate resilience and adaptability. Our expertise encompasses neighborhood shopping centers anchored by essential services, experiential retail destinations, and mixed-use properties that combine retail with residential or office components. We understand the importance of location fundamentals, tenant mix optimization, and the growing demand for retail properties that serve as community gathering places. Our team helps clients identify opportunities in both traditional retail formats and emerging concepts that cater to changing consumer expectations.

Learn more about Retail Investment

Services

Investment Services

Agency Leasing

Maximize your property's income potential with our comprehensive Agency Leasing services. Our leasing professionals understand tenant requirements and market dynamics to secure optimal lease terms and maintain high occupancy rates.

Learn more about Agency Leasing

Asset Services

Enhance property performance and value through our integrated Asset Services. We provide strategic asset management, property operations, and performance optimization to maximize your investment returns.

Learn more about Asset Services

Project & Development Services

Navigate complex development projects with our Project & Development Services. From site selection to project delivery, we ensure your development initiatives meet timeline, budget, and quality objectives.

Learn more about Project & Development Services

Valuation & Advisory

Make informed investment decisions with our Valuation & Advisory expertise. Our certified professionals provide accurate valuations, market analysis, and strategic advisory services to support your investment strategy.

Learn more about Valuation & Advisory

Research

Research • Investment / Capital Markets

MOB Capital Markets 2026 Outlook

Research • Investment / Capital Markets

Top Trends Across Cushman & Wakefield’s Multifamily Portfolio

Research • Valuation

U.S. Senior Living & Care Investor Survey and Trends Report

Article • Sustainability / ESG

Optimizing the Investor Lifecycle

Article • Government / Public Sector

Navigating Tariffs in Real Estate Development: Protecting Projects and Investments

Research • Workplace

Research • Investment / Capital Markets

Research • Workplace

Flexible Office: A Component of Occupier Space Strategies

Research • Investment / Capital Markets

Income is King | Midwest Investor Perspective

Research • Economy

Research • Investment / Capital Markets

Capital Markets 2022 U.S. Outlook

Research • Economy

Infrastructure Investment and Jobs Act: Why it Matters for CRE